Ohenewa: “I would like to introduce you to Mathieu Frohlich with Finance of America Mortgage. Mathieu is a Mortgage adviser at Finance of America Mortgage. They make financing easy and offer a range of options from VA, FHA, Conventional, 203K, USDA, Jumbo Loans, or Hud 184. Thank you for making the time to take this interview with me. What made you get into this field?

Mathiue: “ I have some family, that owned the branch and they showed me how the company works what the opportunities are. They really show the ins and out of how lending works and it was really interesting, they convinced me to join them.

Watch the interview highlights on our youtube channel:

Ohenewa: “How is finance of America different from other mortgage companies?

Mathiue: “Finance of America really empowers their loan officers that are facing the clients. So they really want the individual loan officers to be the ones out finding the clients, building that relationship and give them all the tools they need to be successful, whereas a lot of other lenders are more focused on marketing, advertising bringing in clients through more of a call center type thing where you’re more of a order taker, they give you a client compared to focusing on the relationship between a lender and their client.

Eva: “Can you tell me about some of your loan programs?

Mathiue: “We offer a huge variety of loan programs overall ideas we want to be able to help you no matter what your situation is. Our job as mortgage advisors is to make sure you get the right financing to fit those needs but we do all your traditional loan programs. VA for your veterans, FHA .HUD 184, conventional loans, jumbo loans. Those are more what you consider traditional ones, but we also have a lot of in house loans that we make available so we have commercial ones so people can buy apartment buildings up to twenty units. We have lines of credit for builders so they can build new homes, so we try and be all encompassing for our lending options.

Ohenewa: “What is the most typical program that house hunters here in Alaska look for?

Mathiue: “We have a lot of veterans up here and the VA programs is the best one. That’s what I used to buy my house, is by far the best program has great rate, it’s a zero down program it’s very easy to use, so that one’s extremely popular, the other next one that we see is probably FHA, which is really friendly for first time home buyers.

They work with you, credit issues income issues are very flexible in their terms, as a lot of your first time home buyers will do that and then, of course, your conventional ones.

Conventional loans, you’ll see a lot for anyone making larger down payments or most common is where you’re selling your first home in order to be a move up buyer and buy that larger home.

You just got a promotion and want a bigger house, or your family’s growing, and you need a bigger house so that’s where you will have more of the conventional loan style.

Ohenewa: “I heard that getting multiple loans will badly affect your credit. What are your thoughts on that?

Mathiue: “So, multiple loans is more, how many are we talking about? If we’re talking about credit cards, personal loans, auto loans, things like that there are most of your experience, transunion, equifax, they want you to have several loans out there they want to see that you’re using credit that you’re paying your bills on time and that you have a couple different sources of credit, whether it is at auto loan, home loan, credit card things like that. They want to see a minimum of three trade lines. TransUnion won’t report a credit score if you don’t have at least one active trade line going the longer you have a trade line open, the better credit, a lot of credit is based off of your history. So don’t close a credit card if you’ve had it for a long time to keep it keep using it, use it once or twice a year, just keep the account going over time, as long as you’ve made all your payments. This really helps boost your score, otherwise the number of loans depends on how you’re using them. If all of your credit cards are maxed now that’s a bad thing, if you have ten credit cards, but they all have only ten percent on them for their overall bounds well, then that’s more of a good thing, because then you have a lot of credit that you can use in case of emergencies, unexpected bills or anything like that.

Ohenewa: “What would you say with someone wants to do a refinance but they worried that it could badly affect their credit?

Mathiue: “Having your credit checked normally only affects your score down a couple points, having your credit checked by multiple loans; five, six, seven times that’s where it starts, really taking an adverse hit on your credit so if you go around shopping for different credit cards and you don’t end up actually getting any credit card that’s also seen as bad shopping, with the even lenders, credit agencies expect you to shop around two or three different lenders, but your shop with ten- they start thinking something’s wrong, and you’ll really start hitting that, seeing that hit also hard inquiries you don’t want, you want to keep them down as low as possible. But anywhere in the two to four hard inquiries in a given period of time isn’t seen as that bad, isn’t really going to drive down your credit.

So if you’re thinking about refinancing, if you haven’t applied for any other loans recently, then it doesn’t hurt to have your credit pulled.

Ohenewa: “What is one of the misconceptions that people have about mortgages?

Mathiue: “That like your biggest one is probably that your bank is going to give you a good deal just because you bank with them, or that all lenders, all mortgages, are created equally.

They’re not, all of your companies operate differently they all have different fees they all do things differently and how they operate and so one lender might have a whole different program that meets your needs much more closely than another lender, and you don’t know until you go around in talk with a few of them.

Ohenewa: “Can you work with people outside of Alaska?

Mathiue: “So I’m personally licensed in Alaska, Arizona, California and Oregon, so I can do loans in those individual states but our companies licensed to nationwide and I can always refer to colleague, a fellow lone officer in a different state so it doesn’t matter where you’re looking to buy refinance, we have someone that can help you out.

Ohenewa: “I heard loans gets sold out without consent, is it a standard procedure?

Mathiue: “Every single person sells your loans, every single lender is going to sell your loan except in the rarest of cases it doesn’t matter who the lender is. They all get packaged up in mortgage backed securities and sold off now what happens there is, depending on who buys the package of all those loans at thousand loan block that gets sold off, they might have a deal with a different company, a servicing company that is a one you actually make your payments too.

So the people that own your loan are not the same ones that collect your payment a lot of time and so since they have that arrangement, you’ll get that letter in the mail saying, your servicing provider has just been changed and your loan has been moved because even then, sometimes your loan one can get sold four or five different times and stay at the same service and you’ll never know that that package of loans are sold, the only time you know is when your servicing company changes, and who’s collecting the money is a new company

Ohenewa: “So it’s not really a bad or good thing for the consumer?

Mathiue: “No it doesn’t affect the consumer, the biggest thing is the setting up of a new account with a new service provider to have your mortgage payment automatically withdrawn especially if it’s happened four times in a row, every single payment was made to a new service in the company because no one really had an idea about what was going on so selling them, buying and selling them again and they were just a little frustrated because they’re like, hey, i just may open an account, just made a payment to these guys and now i tried to do the same the following month, and they say, I can’t make the payment because my loan has been moved to another service in company, so it’s more of the frustration factor, but it doesn’t affect your loan you actually have a little more of a grace period during that time that the new account set up, so oh, every month, so don’t think that your grace period means you can skip a payment, but it does mean that if it takes an extra couple of weeks to find out who the new servicer is and to get that payment sent off, that won’t affect your credit that won’t affect your payment history whatsoever ,

Ohenewa: “Are there any email coming up webinars?

Mathiue: “That will be every Wednesday at six pm I want to get that started here in the next couple of weeks, and it’ll just be a consistent every Wednesday six pm, when you’re ready to learn more about buying your first home, or if you just want a refresher on how the home process home buying process works, you can join for free. FAMhomeloans.com

Ohenewa: “What are some tips that you can share with anyone looking to find the right mortgage lender?

Mathiue:“Definitely shop around and look strongly at the loan estimate so all lenders when they get a complete application are required to give you a loan estimate and in there is our best guess scenario on what all of the costs for all of your closing costs are but also what we put in for any origination costs that’s what you really want to focus on how much are you paying to get the loan? Origination costs a lot of times, lenders will charge a flat percentage fee and so that they’re charging one percent of origination fee that can, be quite a few thousand dollars, if you buy four hundred thousand dollar house, if you’re looking at a four thousand dollar origination fee, Finance of America does charge an origination fee, but it is a flat fee it’s one thousand four hundred and ninety dollars, and that’s all of our fees. We don’t have any other fees in there and is for our branch some branches are different based off location our Alaska branch is just a $1490 some other ones will hide in discount points those are the points you pay to buy down your interest rate so they might say, oh, hey, we can beat other lenders by giving you a three percent, instead of a three point two five percent

but that discount point might mean that you’re actually buying down that rate and paying more upfront costs and so they kind of hide it in sometimes other common fees that you’ll see will be something like document preparation fees, admin fees, copier fees they can hide in a bunch of fees in there it’s really focusing on that part the third party costs are going to end up being the same, no matter what lender you use because that’s

an appraisal fees and appraisal fee, we don’t take any money for that, no one else is allowed to take money for that it’s going to be the same, no matter who you use.

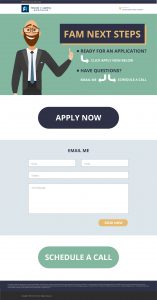

Ohenewa:“Can you tell me a little bit about the work that brushpic has done for you and your business?

Mathiue: “Yeah so brushpic has designed website, has designed powerpoint presentations, some logos, marketing material,and are about to design a couple more websites for me.

Ohenewa: “Bonus Question: If you were shipwrecked on deserted island and had food and water, what two items would you want to bring with you?

Mathiue: “Well, satellite phone and a battery to power it.

Ohenewa: “One last question, what is your favorite hobby?

Mathiue: “I like, getting out to the cabin and spending as much time there as possible

outside of the city and absolutely perfect for four wheel and snow machine and fishing, you name it that’s a fun place to be.”

About the Interviewer

Eva Ohenewa Anno is the founder of BrushPic™. Eva is a multi talented digital artist and entrepreneur with a passion for helping others show up as their best version.